Foundations

Go Private with Your Story

The astounding growth of private markets has not just changed the calculus on IPOs, it's placed a new importance on the importance of your company story.

Otto Pohl

Dec 11, 2024

Share this post

In the olden days, the biggest prize for a company was to go public. If you cleared all the hurdles—regulatory, legal, diligence, analyst perceptions, timing—then your reward was manifold: cash, liquidity, and a fat balance sheet you could use to attract new talent and secure loans. You were in the arena.

Over the past decade, however, private markets have become a massive and attractive new playing field. This impacts how you should tell your company story.

Private markets have grown from $1.6T in 2005 to over $13T in 2023. The effect this has had on startups has been profound—and shows no sign of letting up:

Companies are staying private longer. In the 1980s, the median age of a company was 2 years at their IPO. The average age is now over 10.

Value creation has shifted to private markets. It used to be that a company went public early, allowing public investors to capture much of the upside (every Apple share purchased at their IPO in 1980 for $22 is now worth over $40k). Currently, IPOs are becoming more of an opportunity for private investors to cash in on successful investments rather than a hungry company seeking to grow.

Companies are raising ever-larger rounds more frequently. In the 13 years from 2000 to 2013, there were 51 funding rounds over $100m, or just under 4 per year. In 2021 there were 230 rounds that size.

VC funds are growing. A key reason for mega-rounds is the explosive growth in size of the average VC fund, and the growth of the industry overall. Average fund sizes grew from $84M in 2013 to $154M in 2023. Total assets under management (AUM) in the industry went from $300B in 2008 to $3.5T in 2022—that’s an estimated 25% of all private capital AUM.

Company valuations are rising. When Aileen Lee coined the term “unicorn” in 2013, she found 39 US tech companies with a valuation over $1B—and of those, 62% had already gone public. Just 10 years later, that number was 532, and 93% of those are still in private hands.

Why is tapping private markets often more attractive than going public, or at least a very long detour on the way to an IPO? Private investors can move more quickly with less red tape. And being a public company opens you to all kinds of scrutiny.

But private markets look at companies differently than public markets. Perhaps most fundamentally, venture capitalists and private equity investors are incentivized to seek out massive home runs over a steady stream of singles.

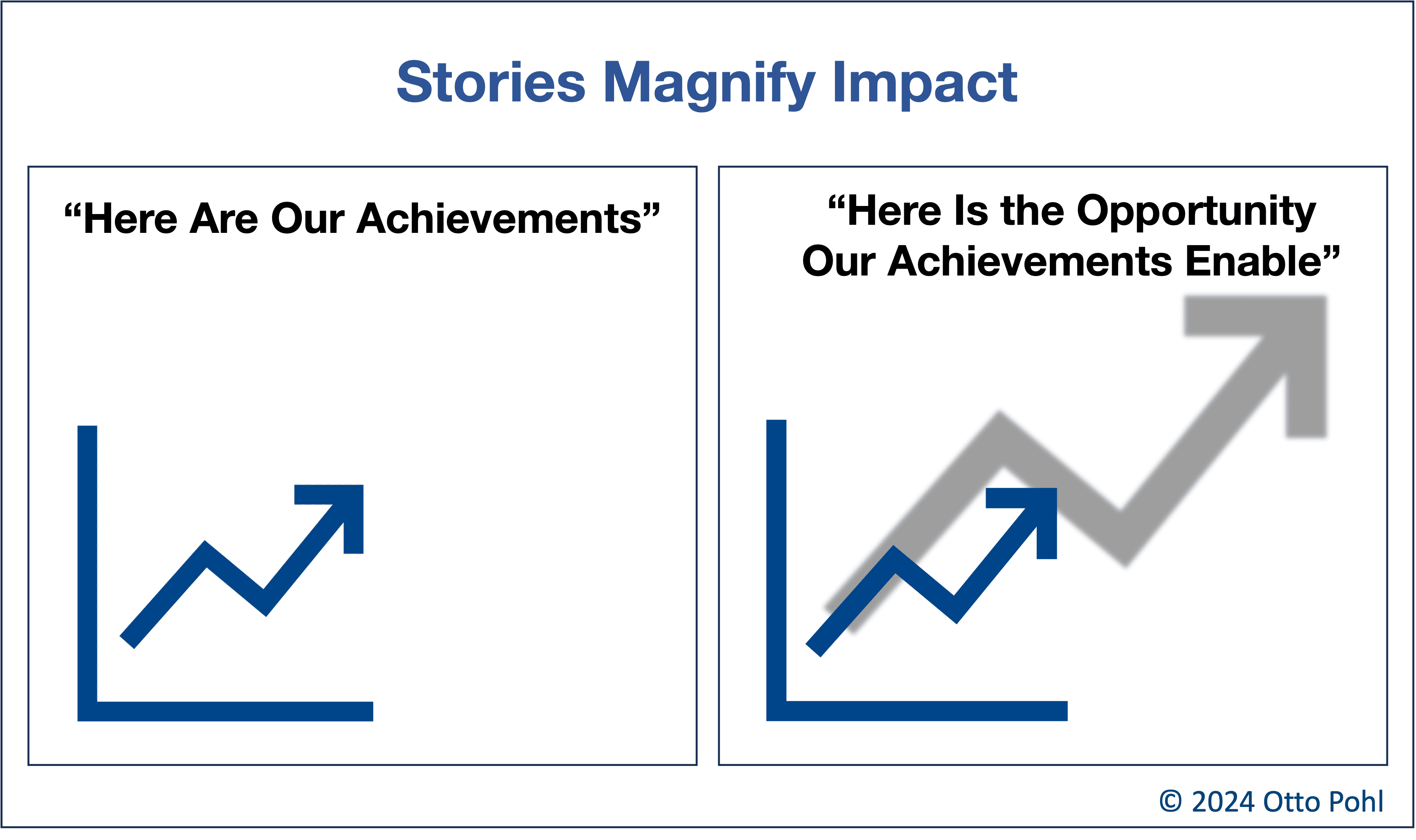

So it’s your job to play to that. Like shadow puppets projected onto a screen, a story magnifies everything you’ve done into the incredible things you plan to do. The shift to private markets makes your story even more valuable.

Two extreme examples illustrate the broader trend. Uber was founded in 2008 and spent over a decade as a private company, spinning ever more dramatic stories about how they were going to expand from delivering people to delivering food to becoming the world’s package delivery service. Private markets valued it at $68B in 2016. When the company finally went public in 2019, it suffered the largest dollar loss ever recorded for a US company when public market investors took one look at the company’s track record and gave it the big thumbs down. (This story ends well—Uber ultimately became profitable and currently has a market cap over $135B.)

WeWork is an example of a story that metastasized into absurdity. Founder Adam Neumann was such a skilled pitchman that private investors fell all over themselves to invest at ever more lofty valuations, peaking at $47B. Private investors bought Neumann’s 2017 claim that WeWork’s “valuation and size today are much more based on our energy and spirituality than it is on a multiple of revenue.” When he tried to romance the public markets with a pre-IPO prospectus that invited investors to “Drop into the World of We,” the bottom dropped out.

I’m not saying that private money is easy or less sophisticated. Far from it—and often the opposite. But private investment is driven to a larger degree by perceived company trajectory. VCs need that massive home run.

Of course, public stock markets have also always had “growth” or “story” stocks, which is another way of saying the company is overvalued when measured against today’s numbers.

The fundamental difference is that you need to conscientiously stage-manage the story your company tells through an often ever-longer series of investment rounds named for letters deeper into the alphabet. The new audience wants that, so it’s important to start practicing right from the start. And while stories that feature massive markets and profit potential are the most common, I’ve seen and worked with companies who use potential social or health impact to also drive a powerful, investable thesis.

The key thing to remember is this: numbers never tell the story. They don’t speak for themselves. What gives them impact is the frame and narrative you put them in. And that has never been more important since private capital has come to dominate an ever-larger piece of the startup lifecycle.

Share this post

Otto Pohl is a communications consultant who helps startups tell their story better. He works with deep tech, health tech, and climate tech leaders looking to create profound impact with customers, partners, and investors. He has taught entrepreneurial storytelling at USC Annenberg and at accelerators across the country.